Listen To The Article

The Special Window for Affordable and Mid Income Housing (SWAMIH) investment fund has finished more than 20,000 homes worth 12,000 crores since its launch in 2019.

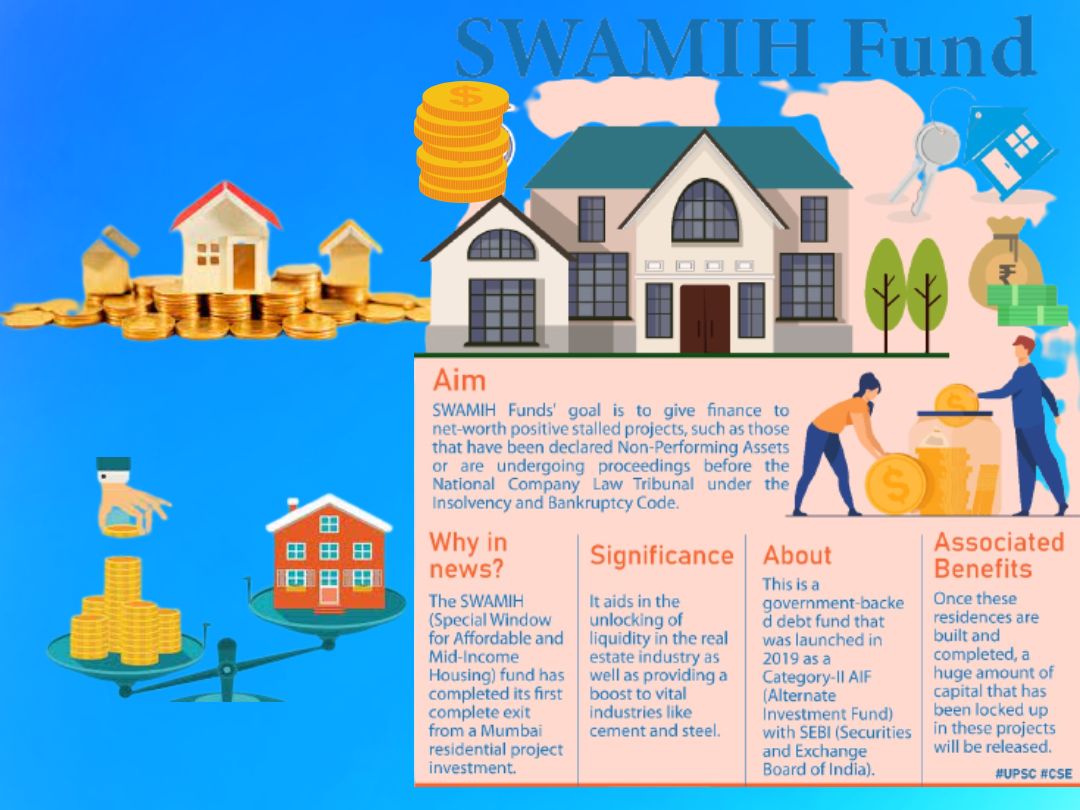

The Union Finance Ministry is funding the SWAMIH fund, which is aimed at debt financing of distressed and affordable housing properties.

Stressed properties are repossessed properties from a defaulting borrower purchased at a reduced price to revive the remaining loan amount.

Brownfield properties are previously developed lands that are no longer in use for a number of reasons, such as soil pollution, hazardous waste, and pollution.

Centre funded SWAMIH fund has one of the widespread domestic real estate private equity teams focused on monitoring and funding the completion of distressed housing properties.

What Exactly Is The SWAMIH Fund?

SWAMIH investment fund was launched in November 2019 with the objective of completing stressed and brownfield properties registered under the Real Estate Regulatory Authority (RERA). It is a government-funded program managed by SBICAP Ventures, the State Bank Group’s Limited.

The project identifies recognized developers with a track record of stalled projects, NPA accounts, customer complaints, and even projects with legal issues, as well as first-time developers.

The SWAMIH fund has one of the largest domestic real estate private equity teams focused on monitoring and funding the completion of distressed residential properties.

What’s The Latest Update On The SWAMIH Fund?

This project has approved around 130 projects totaling 20,557 homes. The cost has exceeded 12,000 crores in total. It aims to complete over 81,000 homes in tier 1 and 2 cities over three years. The fund has finished building 26 projects and is creating returns for its investors.

SWAMIH Fund has also played a critical role in the growth of many subsidiary industries in the real estate and infrastructure sectors, successfully unlocking over Rs. 35,000 crores of liquidity. It has so far raised a total of 15,530 crores to continue funding.

Source- The Hindustan Times