Listen To The Article

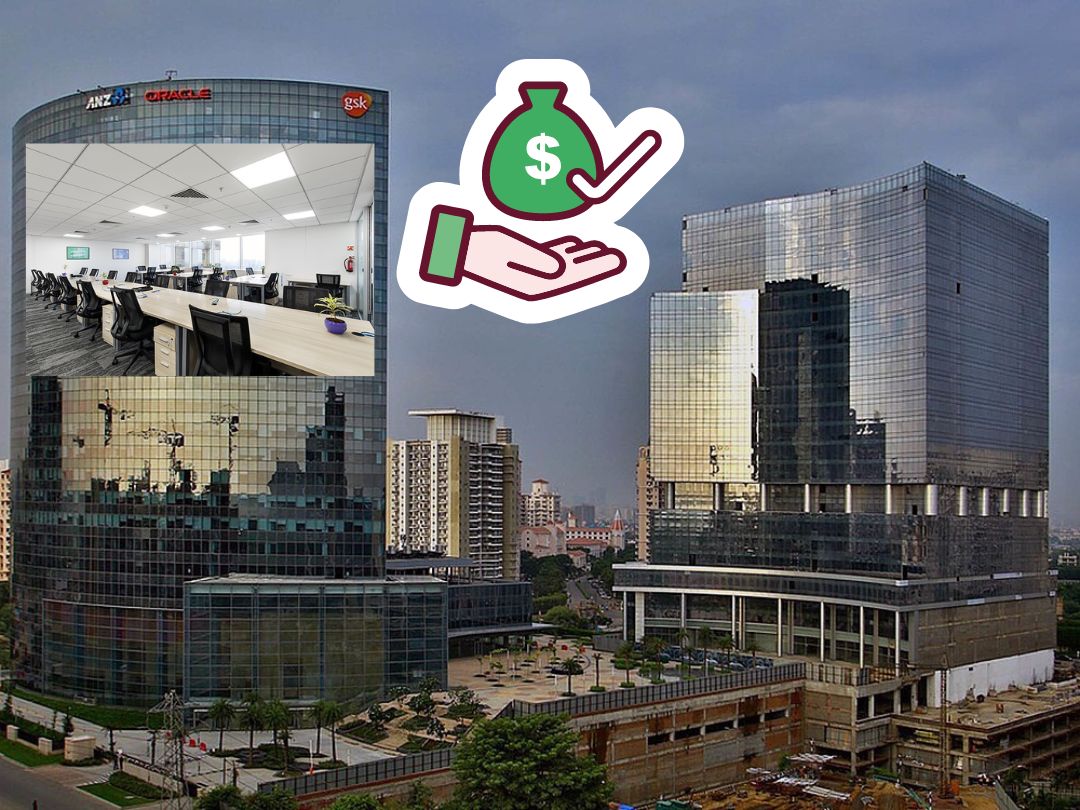

Mohan Exports, the parent company of Mohan Group, has purchased approximately 27,000 square feet of premium office space at DLF Horizon Centre on Golf Course Road in Gurgaon from Hero Cycles for Rs 80.66 crore.

DLF, which is also a leading lease-rental company, sold several office floors to prominent families and corporations between 2014 and 2019, but then stopped selling. DLF limied repurchased Hines’ 51.8% stake in one tower for 780 crores in the year 2021. DLF and its family members currently own 60% of the Horizon Centre.

Hero Cycles did not respond to the email guery, and Mohan Exports did not respond to the email guery. Mohan Exports paid Rs 5.64 crore in stamp duty, according to a copy of the sale deed.

The Mohan Group is involved in global trade, infrastructure developments and industrial projects, and SEZs. Kshitij Jain of Rizin Advisory and Foreo Advisory confirmed the transaction as a multi-family office consultant for clients in India.

“This office was already leased to a co-working player, and the winning bidder’s exit yield worked out to be around 6%.” This establishes the commercial office market’s positive outlook, mainly with marquee assets and other pre-leased offices.

“This sale has resulted in a clear hike in pricing, mainly in metro cities, which will result in upcoming yield solidities,” Jain said. During the first quarter of 2023, USD 45 million (INR 3.7 billion) was invested in India real estate.

Recent global financial events, such as the failure of Silicon Valley Bank and the spread of the contagion to other mid-market US banks, have added to the overall uncertainty in India’s office leasing market appetite. This is reducing investor confidence in making big bets in the short term.

“Because there is a scarcity of good quality commercial properties for sale on Golf Course Road, as well as a limited scope of new developments, investors are constantly on the lookout for good assets in this micro market.”

“Any space available for sale finds a buyer due to a gap in demand and supply,” said Vibhor Jain, managing director, Cushman & Wakefield, North India. The commercial office assets remained the top performer in the first quarter of 2023, and contributed for approximately 64% of total investment.

Source- ET