Listen To This Article Here is the good news for Amrapali Group's troubled home buyers, the Supreme Court was notified on Friday that 11,858 apartments will be delivered in 2 to 3 months, with 5,428 units being turned over in October. Court receiver senior lawyer R Venkataramani informed a bench of Chief Justice UU Lalit and Justice Bela M Trivedi that during the impending Christmas season...

Real Estate

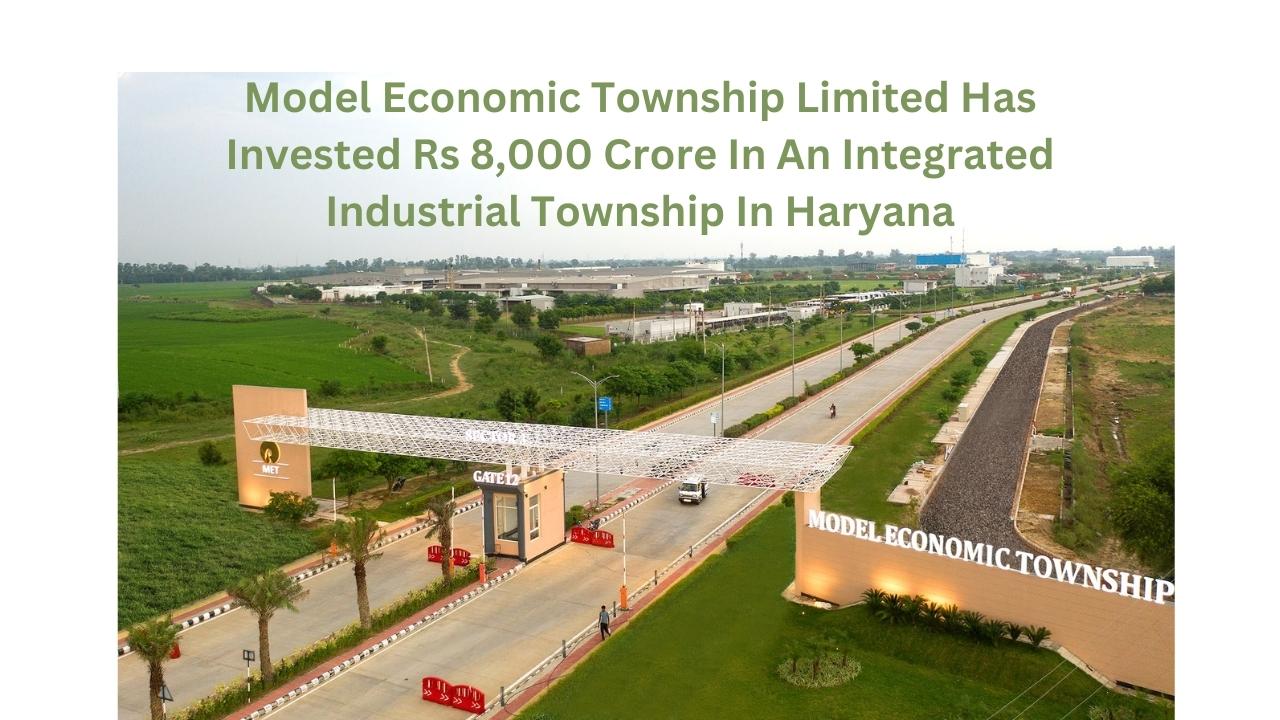

Listen to This Article 400 companies, including nine blue-chip firms, have purchased industrial land. The overall investment from these enterprises is estimated to be around Rs 9,000 crore, with 51,000 people directly employed once operations commence. Model Economic Township Limited (METL) is a wholly owned subsidiary of Reliance Industries Limited that is developing an integrated industrial...

The Haryana real estate regulatory authority (HRERA) fined ISH Realtors Rs 12 lakh on Wednesday for selling flats in a commercial project without a licence from the relevant department. The DTCP (Department of Town and Country Planning) granted a licence to seven landowners working with Jitender Jhangu for the building of a commercial project on 3.7187 acres of land in the revenue estate of village...

The department of town and country planning (DTCP) has directed developers of 17 residential societies undergoing structural audits to deposit the cost in an escrow account. The funds will then be distributed to the four agencies conducting the audit. During the 45-day process, the structural audit will cover more than 200 towers, covering an area of around 2.5 crore sq. ft. in 17 residential...

The sports complex has a total area of 6.4 lakh square feet and a total projected project cost of Rs 350 crore. Lt Governor V K Saxena of Delhi lay the groundwork for a world-class international cricket-football stadium with a 30,000-seat capacity in Dwarka on Saturday. The arena, which will span 51 acres in the sub-Sector city's 19 B, will be built through a public-private collaboration, according to...

These societies rely mainly on diesel generators in the lack of a proper electric connection due to inadequate electrical infrastructure. The Dakshin Haryana Bijli Vitran Nigam (DHBVN) has threatened to nullify project permits for 25 housing societies in new locations along the Dwarka Expressway if their developers do not secure a solid electrical connection within the next two weeks. Because of a...

The Delhi Real Estate Regulatory Authority (RERA) has directed the Delhi Development Authority (DDA) to register all current e-auction programmes where plots, flats, or retail shops are still for public sale by May 1, 2017. The decision was issued in response to complaints from the Residents Welfare Association of Rohini, where plots were auctioned in 2013 but improvement work was not completed by the...

On September 8, Gurugram Deputy Commissioner Nishant Yadav issued an order stating that if such a registry is carried out, severe action will be taken against the responsible Tehsildar and registry clerk. If you want to buy a floor in Gurugram on a property less than 180 square yards, you may get into difficulties and lose your money. On September 8, Gurugram Deputy Commissioner Nishant Yadav issued...

On this land tract, MaxVIL, a subsidiary of Max Group, intends to build a commercial project with a leasable area of 1.6 million square feet, marking its entry into the Gurugram real estate market. It already has a footprint in the property marketplaces of Noida and Delhi. The acquisition will allow Acreage Builders' over 7-acre land tract in Gurgaon's lucrative Golf Course Extension Road to be used by...

Omaxe Chowk aims to become an end-to-end jewellery marketplace by integrating a diverse range of jewellery solutions under one roof. Tanishq, Senco, and Giva have signed up for flagship stores in Chandni Chowk at Omaxe Chowk, taking nearly 11,000 square feet of space in Jewel Court. Other prominent companies, including traditional jewellers from throughout India, are also lining up to sign at Omaxe...